Colorado Democrats hope to create one of the nation’s first taxes specifically aimed at firearms and ammunition, but the sponsor says she's interested in raising funds, not discouraging gun ownership.

A new proposal at the state legislature could ultimately increase the cost of firearms, ammunition, and gun parts by 11 percent. If it passes the legislature, the measure would go before voters this November. Only California has passed a similar tax in recent history.

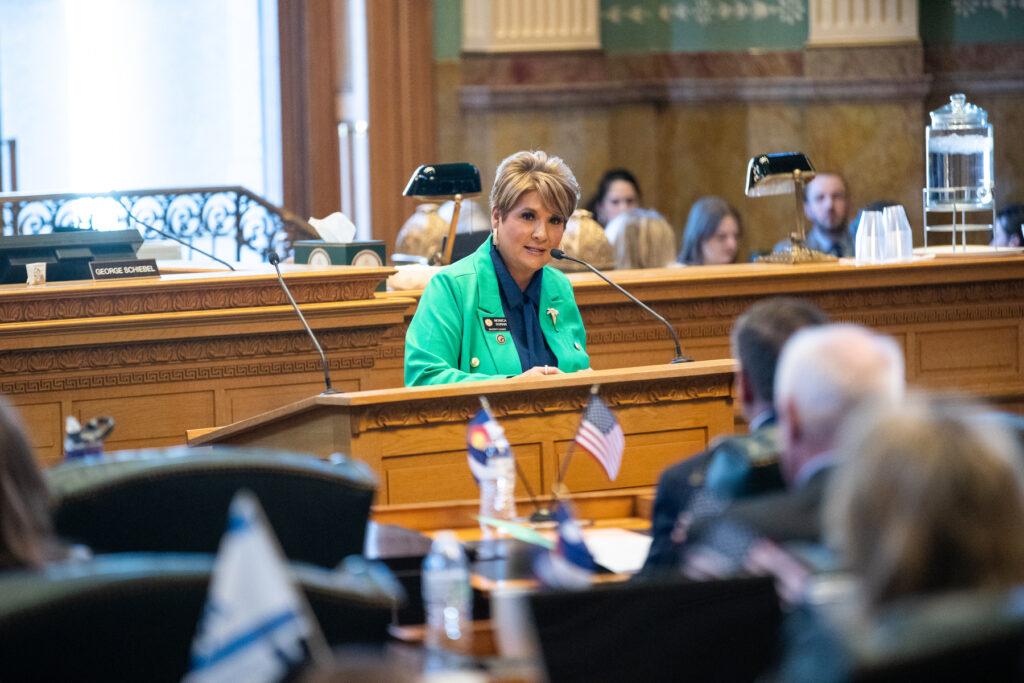

The sponsor of HB24-1349 — Rep. Monica Duran of Jefferson County, the House Majority Leader — argues that it’s “not a gun legislation bill.” Instead, she says, the point is to raise an estimated $60 million a year to support crime victim services and other causes.

“It's not removing anything. It's not impacting anyone's Second Amendment rights whatsoever,” Duran said in an interview. “This is really looking at keeping those services available that families, parents and kids need.”

Various Democrats have introduced a wide range of gun-related proposals this year, including restrictions on carrying firearms in many places and a ban on so-called ‘assault weapons.’ Gun rights advocates argue that imposing a new tax on firearms would be an obstacle that adds new costs to exercising a constitutional right.

“This tax should be seen as nothing more than an attack on the Second Amendment and those who exercise their rights under it,” declared the National Rifle Association's Institute for Legislative Action, in response to the Colorado proposal.

Money would primarily go to help crime victims

If it’s approved by the legislature, the next step would be to put the question to voters, who have the sole power to raise taxes in Colorado. The question would appear on the ballot in the 2024 election, where it would have to win a simple majority of support to pass. If it does, the new taxes would go into effect in April 2025.

Each year, the first $45 million raised by the tax would go to the state’s Crime Victim Services Fund. That pays, for example, for grants to nonprofits that provide temporary housing, attorneys, and physical exams for domestic violence survivors, as well as for victims of other crimes.

“I didn't have that as a domestic violence survivor,” Duran said.

This would be a substantial change for crime victims funding, which previously has been appropriated year by year — and which the state has struggled to prioritize in the face of declining federal support, Duran said.

Further gun tax money would go to causes such as mass shooting responses; enforcing hunting laws; and supporting firearm and shooting range safety programs.

Currently, Colorado taxes firearms at the same rate as most other goods.

The idea of state-level gun taxes has only recently started catching on elsewhere, with California passing the first law like this last year.

While Colorado voters have consistently rejected across-the-board tax increases, they’ve been willing to increase taxes on specific products or income brackets, especially when the money raised goes to very specific programs. In 2020 they agreed to increase nicotine taxes to pay for universal pre-K. And two years later, voters raised taxes on those making more than $300,000 a year to cover free school lunches for all students.

Gun-specific taxes have a history in the U.S.

Nationwide, there has been a similar federal levy on guns for a century through the Pittman-Robertson Act, which taxes guns and ammunition at 10 percent or 11 percent.

That federal tax generates hundreds of millions of dollars a year for conservation and hunting programs — an effort that drew praise from the NRA’s ILA in 2001 as a “rare legislative model for efficiency and a godsend for hunters and animals alike.” (The group didn’t immediately respond to a request for comment.)

Historically, other states also have had similar taxes dating back to the 1840s, according to the Colorado bill’s drafters. That could be a key legal question, since the U.S. Supreme Court has ruled that firearms restrictions must be consistent with America’s historical tradition of regulation — which can require looking back at laws over the centuries back to the Founding Era.

“We've been assured that it's not conflicting with anything constitutional,” Duran said. “It’s an excise tax, and it goes to the vote of the people.”

Duran, who owns a variety of pistols and long guns, said the tax isn’t meant to discourage gun purchases. The introduction to the bill argues that it would “generate sustained revenue for programs that are designed to remediate the devastating impacts of these products on families and communities across the state.”

It’s unclear what effect a new tax would have on gun sales, especially since there are so few similar examples, according to a research summary from the RAND Corp.

“Researchers currently have little evidence to suggest whether this strategy will be effective in reducing gun deaths and injuries, and effects will depend on the amount of revenue collected and how that revenue is targeted,” the report stated.

Retail sales to law officers and agencies would be exempt, as would sales by manufacturers and vendors who sell less than $2,000 of guns and ammo each month. Dealers, manufacturers and vendors who do collect the tax would have to send it in monthly to the state.

Maryland, Vermont, New York, Massachusetts, Washington, and New Mexico have all considered similar measures recently, though only California has passed one. Several cities have also done so.

The Colorado measure is scheduled for a committee hearing late this month.