Colorado’s highest-ranking state lawmakers completed a noteworthy deal on Wednesday, passing a bill that will permanently lower one component of commercial and residential property taxes in Colorado.

The bipartisan compromise, backed by Gov. Jared Polis, was supposed to be the conclusion of a years-long political battle. The measure passed the legislature with huge margins — only eight of the state’s 100 lawmakers opposed the bill in its crucial final votes.

“I’m really proud of this work that we've done here because we've offered more than a billion dollars a year of property tax relief, but done it in a way that doesn't gut our schools,” said Sen. Chris Hansen, a Democratic architect of the plan.

And yet, even as lawmakers took a victory lap inside the Capitol, outside, key players outside were declaring “no deal.”

Groups representing businesses and conservatives say the new law doesn’t offer enough tax relief for home and business owners, and they’re prepared to ask Coloradans to do more.

“It’s not a serious proposal. And unless something changes in the meantime, we think the voters will agree,” said Josh Penry. He’s an adviser to the conservative political group Advance Colorado and the business group Colorado Concern.

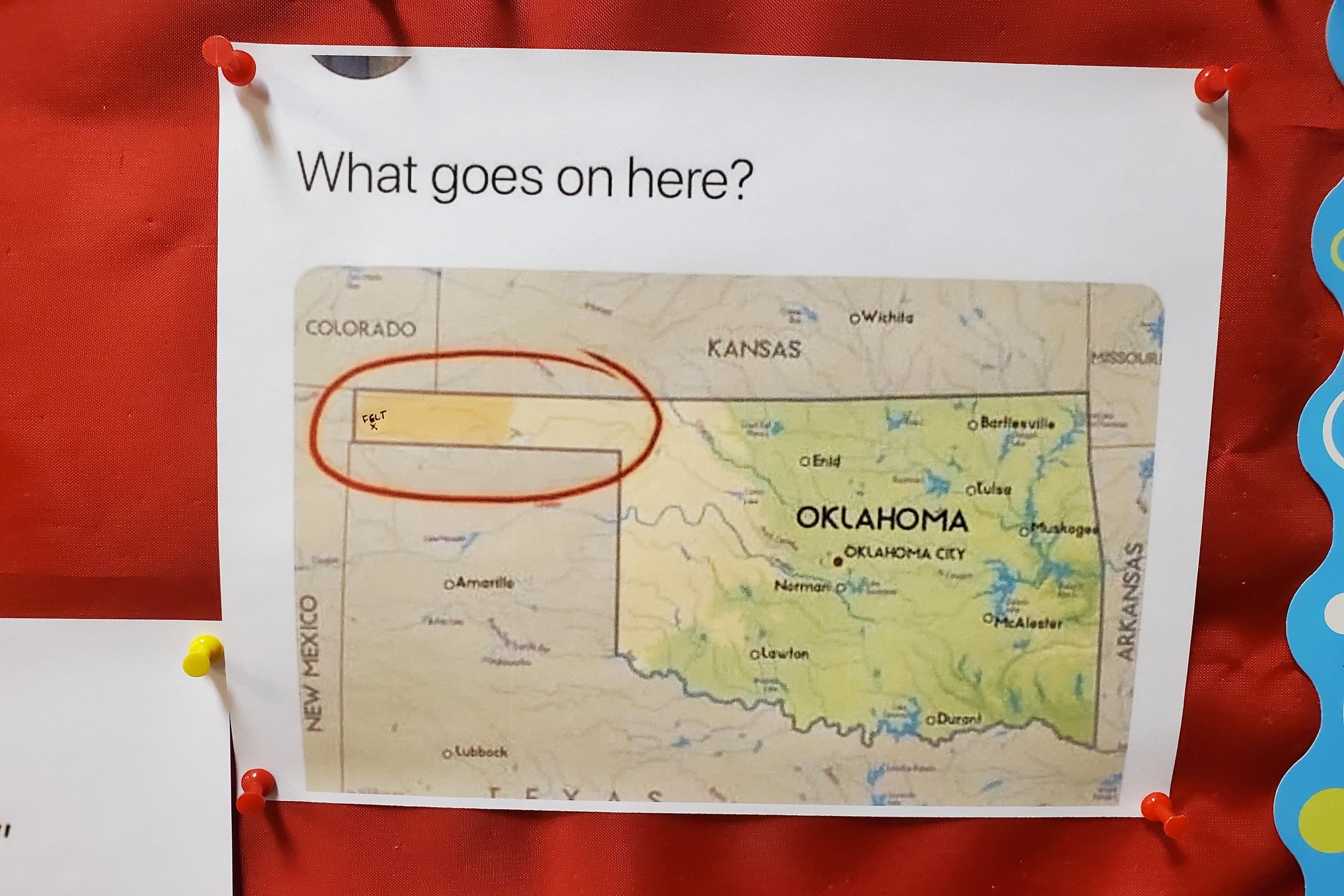

Those two organizations were pushing for the deal to yield larger property tax cuts. Now they are supporting two measures that could appear on the ballot this November: Initiative #50, which would apply strict limits on future property tax growth, and Initiative #108, which would slash current tax bills.

Penry said dramatic action is needed, after recent spikes driven by a hot property market. “Property taxes have increased by between 20 and 40 percent, on top of record breaking increases,” he said. Critics on the left — and even some on the right — have said those measures go too far and would throw state finances into chaos.

“I think these groups really have to decide whether or not moving forward with these disastrous measures is in the best interest, not only for the state, but for their own organizations,” said Scott Wasserman, president of the progressive Bell Policy Center.

All this sets the stage for an unusual political faceoff this November. Numerous Republican lawmakers support the bipartisan tax deal. Now, they may find themselves head to head with two groups that are normally their allies.

Sen. Barbara Kirkmeyer, a Republican who was central to the tax bill, said she hadn’t yet read the business and conservative alliance’s ballot proposals. She stressed that her role was in the legislature.

But she was concerned about the initiatives’ potential effects on schools and local governments in particular. They could obligate the state to come up with billions of dollars in “backfill” to make up for the effects of small local tax collections for schools.

“I want to make sure that we adhere to the Constitution, which requires, again, whether you like it or not, things are balanced up,” she said.

Colorado Concerns' rejection of the legislative deal also met with opposition from one of its own board members. Janine Davidson, president of Metropolitan State University of Denver, stepped down from the board last Thursday.

“[Colorado] Concern’s proposed direction on the property tax issue poses significant challenges and adverse effects on our colleges and universities, our students, and our Colorado community,” she wrote in a letter obtained by CPR News.

Savings or semantics?

The lawmakers behind the bipartisan property tax bill describe it as saving more than $1 billion for property owners each year, compared to the state’s current trajectory.

But their opponents say that even with the change, the effective property tax rate will still rise for many homeowners — compared to what they’re paying now.

So, who’s right?

A little context: Property tax bills have been temporarily discounted for several years. As property values rose sharply in recent years, the state legislature had temporarily lowered the “valuation rate,” which determines how much of a property's value is taxed.

Those discounts are set to expire, meaning if nothing is changed, the valuation rate will rise next year.

With the bill that lawmakers passed Wednesday, the legislature took action to partially cancel out that increase in tax rates. The discounts will be continued for an extra year.

After that — for taxes paid in 2026 and beyond — the valuation rate would rise somewhat for some homeowners. But it wasn’t possible to permanently continue the current temporary discounts, said Sen. Hansen.

“We can't conjure up money out of thin air, we had to do it with the resources that we have. And that's exactly what this proposal in Senate Bill 233 does. We use all the resources we've got available, deliver as much tax relief as we possibly can, but do it in a way where there is no damage to the schools,” Hansen said.

The bipartisan bill also creates a new limit — 5.5 percent per year — on the growth of local property tax revenues for many districts. That limit doesn’t apply to school districts or to home-rule cities like Denver.

All told, homeowners may save more than $1 billion compared to what could have happened. That could be worth a few hundred dollars for a typical home in many cities.

The bill largely exempts school districts from its rate cuts and limits — which is why it has a relatively small effect on the state budget or TABOR refunds, but also why its savings for taxpayers are more limited than what the outside groups want to see.

“Our proposal does not cripple the state budget. It does not require TABOR surplus … It is permanent,” Kirkmeyer said.

But the business and conservative groups argue that’s not enough. They say that lawmakers are still allowing a tax increase to happen, compared to the temporary discounts.

“The notion that you can’t responsibly fund your schools and your fire services without massive unaffordable property tax increases, it’s a fiction,” Penry said. “We’re going to put the facts in front of folks.”

The bipartisan tax bill goes next to the governor for a signature, which he is certain to give. Meanwhile, one of the ballot measures, Initiative #50, has already qualified for the November ballot.